Breadcrumb navigation

Corporate Governance(As of June 23 2023)

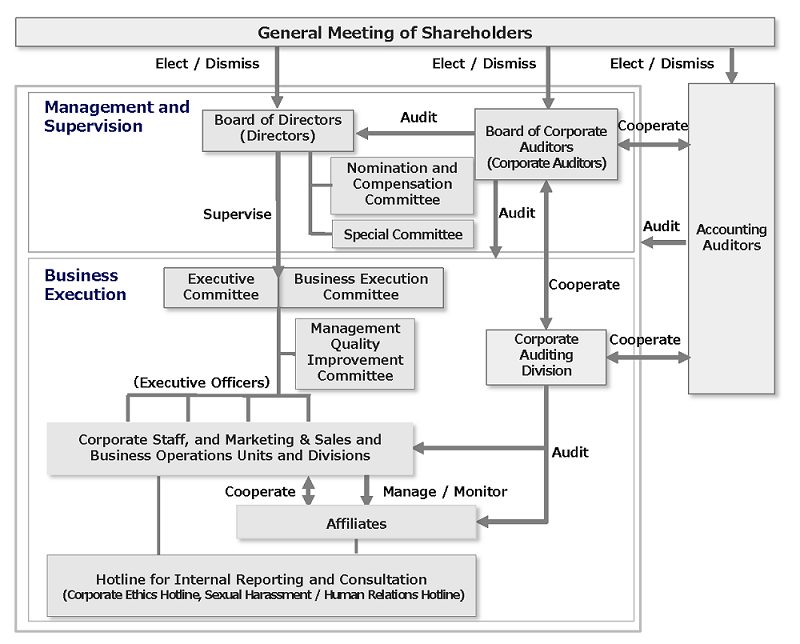

NEC Networks & System Integration CorporationThe Company believes that the cornerstone of corporate governance is ensuring management soundness and transparency by establishing a management system that enables quick decision-making to respond promptly to changes in the operating environment, and by practicing timely, appropriate disclosure. To that end, the Company has adopted a Board of Corporate Auditors system and has established a corporate governance system in which the Board of Directors and Board of Corporate Auditors play key roles.

I. Description of Corporate Organs

(1) Board of Directors and Board of Corporate Auditors

The Board of Directors is composed of nine Directors, including three outside Directors. In addition to maintaining the number of Directors at an optimum level for quick decision making, the Company has regulate the terms of Directors to one year in order to clarify the management responsibility of Directors and strengthen its management structure.

The Board of Corporate Auditors consists of four Corporate Auditors, including two outside Auditors. It decides audit policies and related matters, and reports on the status of audits performed by each Auditor. Corporate Auditors also attend Board of Directors meetings and other important meetings, examine significant documents related to final decisions, and listen to Directors and employees on performance of their duties, thus contributing to a system for sufficiently scrutinizing Directors' performance of their duties. The Company is staffed to assist the execution of duties of Corporate Auditors.

(2) Nomination and Compensation Committee

The Nomination and Compensation Committee has been established to deliberate and examine the nomination and remuneration of Directors from the viewpoint of ensuring transparency, validity, and objectivity.

The Committee consists of the representative director and independent outside Directors, and the chair of the Committee is elected from independent outside Directors.

The Committee shall discuss the following matters and report the contents and results of these discussions to the Board of Directors as appropriate. However, personnel matters related to corporate auditors shall be subject to the consent of the Board of Corporate Auditors.

- Matters concerning the personnel of the Board of Directors and the representative director

- Matters concerning the compensation and bonuses of directors and the representative director

- Matters concerning the personnel of the Board of Corporate Auditors

- Matters concerning the succession plan of directors, etc.

- Important matters concerning other personnel and compensation

(3) Special Committee

The Special Committee has been established to deliberate and review material transactions or actions that conflict with the interests of the controlling shareholder and minority Shareholders.

The Committee consists of independent outside Directors and the chair of the Committee is elected from them.

The Committee shall discuss the following matters and report the contents and results of these discussions to the Board of Directors as appropriate.

- Status of major transactions with NEC

- Conclusion of contracts in regard to M&As (including business transfers and acquisitions, divestitures, and mergers) with NEC and its subsidiaries

- Other important matters that may conflict with the interests of NEC and the Company’s minority shareholders

(4) Executive Officers, Executive Committee, and Business Execution Committee

The Company has adopted an executive officer system to clearly demarcate the supervisory function and the business execution function. Based on the executive officer system, the Company also formed the Executive Committee, to discuss policies pertaining to key management and operating issues, consisting of mainly executive officers at senior vice president level and higher and Corporate Auditors, and the Business Execution Committee, to monitor the progress of and report on significant matters concerning business execution.

(5) Corporate Auditing Division

The Corporate Auditing Division has been established as an internal audit unit independent from the business execution divisions. It examines through internal audits whether business execution is being conducted legally and properly according to relevant laws, regulations and Company rules.

(6) Accounting Auditors

The Company has an audit contract with KPMG AZSA LLC as its accounting Auditors. KPMG AZSA LLC expresses its views on the financial statements as an Auditor from an independent viewpoint.

II. Development of Internal Control Systems

The Company has established a basic policy for the development of internal control systems, as shown below, under Article 362, Paragraph 4, Item 6 of the Companies Act and Article 100, Paragraphs 1 and 3 of the Enforcement Regulations of the Companies Act. The Company maintains the appropriate execution of operations under the basic policy, laws and regulations, and internal regulations.

III. Situation of Outside Director and Outside Corporate Auditors

Of the Company’s nine Directors, three are outside Directors. The Company believes that this is a sufficient number for giving advice and participating in decision making from a fair and objective standpoint, thereby strengthening the Company’s corporate governance.

Outside Director Michiko Ashizawa has an abundance of experience, including business experience as a certified public accountant at an audit firm and engaging in revitalization projects of major companies at Industrial Revitalization Corporation of Japan. She also possesses expertise in business administration as a whole, mainly researching M&A for corporate restructuring and serving as an instructor at a graduate school. The Company believes she will continue to be capable of playing an appropriate role in matters such as giving advice and providing supervision relating to management of the Company from an objective standpoint by making use of her extensive experience in finance and management. Ms. Ashizawa attended 13 out of 13 meetings of the Board of Directors held in the fiscal year ended March 31, 2023. She has been designated as an independent Director as defined in Rule 436-2, Paragraph 1 of the Securities Listing Regulations of the Tokyo Stock Exchange.

After joining a major electrical appliance manufacturer, Outside Director Mamoru Yoshida demonstrated excellent management skills and strategy building ability through his career as manager of various areas, including overseas business. He also served as a person in charge of technology and gained extensive knowledge and experience in technology management, manufacturing, marketing, etc. Since 2016, he had promoted corporate management governance reform as Senior Audit & Supervisory Board Member. The Company believes he will continue to be capable of playing an appropriate role in matters such as giving advice and providing supervision relating to management of the Company from an objective standpoint by making use of his manufacturing knowledge and extensive experience in corporate management. Mr. Yoshida attended 12 out of 13 meetings of the Board of Directors held in the fiscal year ended March 31, 2023. He has been designated as an independent Director as defined in Rule 436-2, Paragraph 1 of the Securities Listing Regulations of the Tokyo Stock Exchange.

Outside Director Mikiko Morimoto, after gaining experience in macroeconomic research and analysis and fund management at private companies such as private think tanks, and consulting in areas such as corporate and organizational sustainability, the promotion of SDGs, and ESG response, established a consulting company that provides comprehensive support for sustainability management, at which she serves as CEO. The Company believes she will be capable of playing an appropriate role in matters such as giving advice and providing supervision relating to management of the Company from an objective standpoint by making use of her experience in the economics and finance fields as well as her high level of knowledge in sustainability. She has been designated as an independent Director as defined in Rule 436-2, Paragraph 1 of the Securities Listing Regulations of the Tokyo Stock Exchange.

Outside Corporate Auditor Akiko Isohata has specialized knowledge of the Companies Act and corporate governance, and the like, and has a wealth of experience as a lawyer in the field of general corporate legal affairs. Although she has not been involved in business management, the Company believes she will audit the legitimacy of its business operations from a fair and objective standpoint, by making use of her knowledge and experience. Ms. Isohata attended all 11 meetings of the Board of Directors and all 10 meetings of the Board of Corporate Auditors held in the fiscal year ended March 31, 2023 after her appointment on June 24, 2022. Ms. Isohata has been designated as an independent Auditor as defined in Rule 436-2, Paragraph 1 of the Securities Listing Regulations of the Tokyo Stock Exchange.

Outside Corporate Auditor Koji Inagaki has been engaged in audit work for many years at an audit firm as a certified public accountant, has deep knowledge of finance and accounting, and in addition, has gained a wealth of experience in management, including overseas operations and promotion of innovation by using digital technology, as Deputy CEO of an audit firm. The Company believes he will be capable of auditing the legitimacy of its business operations from a fair and objective standpoint, by making use of his knowledge and experience. Mr. Inagaki has been designated as an independent Auditor as defined in Rule 436-2, Paragraph 1 of the Securities Listing Regulations of the Tokyo Stock Exchange.

Of the Company’s four corporate Auditors, two are outside Corporate Auditors. We believe that this is a sufficient number for auditing the Directors’ execution of their duties from a fair and objective standpoint, thereby strengthening the Company’s corporate governance.

There are no special interests between the Company and its outside Directors or outside Corporate Auditors.

The outside Director and the outside Corporate Auditors regularly exchange information and consult with the Corporate Auditing Division and staff departments, receiving reports on business execution at meetings of the Board of Directors and on other occasions.

The outside Corporate Auditors cooperate with the independent Auditors, exchanging information and consulting with them regularly at meetings of the Board of Corporate Auditors and on other occasions.